The TD First Class Travel® Visa Infinite* Card offers a solid welcome bonus, generous earning rates, and strong travel insurance.

This card earns flexible TD Rewards Points, which can be redeemed in a number of ways but are most valuable when redeemed for travel booked through Expedia® for TD.

In this review, we’ll explore what’s on offer with this card to help you determine if it might be worth adding to your wallet as part of your overall Miles & Points strategy.

At a Glance

- Annual Fee: $139

- Supplementary cardholders: $50 (for first card), $0 (for all additional cards)

- Minimum annual income: $60,000 (personal, $100,000 (household)

- Estimated credit score: Good to Excellent

- Rating: 4/5

What we love: airport lounge access, good travel insurance, and flexible points redemptions

What we’d change: remove foreign transaction fees to make it a stronger travel credit card choice

Rotating Strong Welcome Bonus

In the last few years, the TD First Class Travel® Visa Infinite* Card has offered a welcome bonus that ranges from 75,000–165,000 TD Rewards Points, which are worth around $375–675 (all figures in CAD) in value depending on how you choose to redeem the points.

The welcome bonus is typically offered in a couple of chunks, with a small percentage being earned upon your first purchase and the rest being earned after you meet a single minimum spending requirement.

As always, with a minimum spending requirement, you’ll want to be conscientious when applying for the card to make sure you have enough upcoming expenses to earn the full welcome bonus. Pleasantly, the minimum spending requirement for the TD First Class Travel® Visa Infinite* Card has historically been very reasonable, requiring around $5,000-7,500 in spending over a 180-day period.

With the card also often waiving the annual fee for the first year, this is a very strong welcome offer that can add some real value to your Miles & Points portfolio.

TD First Class Travel® Visa Infinite* Card

- Earn 20,000 TD Rewards Points upon making your first purchase†

- Earn 145,000 TD Rewards Points upon spending $7,500 within 180 days of account opening†

- Plus, earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Plus, earn 8x TD Rewards Points† on eligible travel purchases when you book through Expedia® for TD†

- Get an annual TD Travel Credit† of $100 when you book through Expedia® for TD†

- Use your rewards for any travel bookings available on Expedia® for TD†

- Four complimentary lounge visits through the Visa Airport Companion Program†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $139, rebated for the first year†

- Offer effective as of September 4, 2025†

Strong Earning Rates

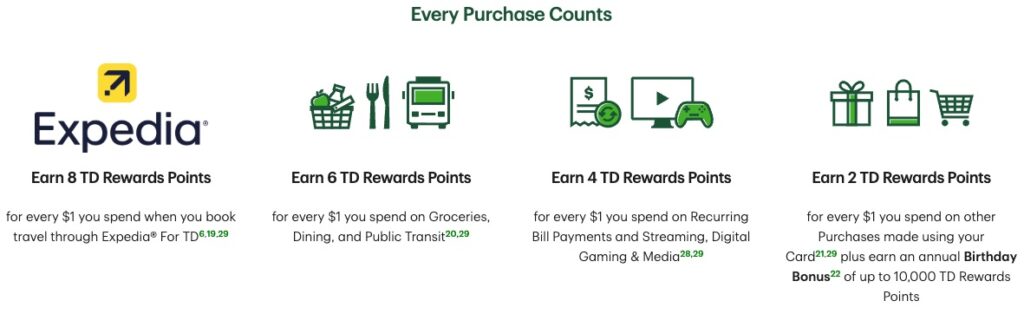

The TD First Class Travel® Visa Infinite* Card earns TD Rewards Points in a tiered structure, as follows:

- Earn 8 TD Rewards Points per dollar spent on eligible travel booked through Expedia® for TD †

- Earn 6 TD Rewards Points per dollar spent on eligible groceries and restaurants †

- Earn 4 TD Rewards Points per dollar spent on eligible recurring bill payments, streaming, digital gaming and media purchases †

- Earn 2 TD Rewards Points per dollar spent on all other eligible purchases †

These rates are equal to a 4%, 3%, 2%, and 1% return, respectively, if you choose to redeem your points for their maximum value of 0.5 cents per point, available on travel booked through Expedia® for TD.

If you often book your travel through Expedia (or you’re willing to start doing so), these are some particularly generous earning rates.

Plus, earning up to 3% in return value on groceries and restaurants and up to 2% back on recurring bill payments is pretty good by any measure, albeit not the best in Canada.

It’s worth noting that there’s a $25,000 annual spending cap for each of the elevated categories. Once you’ve reached it, your earning rate will drop down to the baseline rate of 2 TD Rewards Points per dollar spent.†

Flexible Rewards Currency

As we mentioned above, the TD First Class Travel® Visa Infinite* Card earns TD Rewards Points. These flexible points can be redeemed in many different ways, including for merchandise, gift cards, statement credits, and travel.

Although TD Rewards Points can’t be transferred to any external airline or hotel loyalty programs, you can still redeem them for flights, hotels, and other travel expenses by either booking through Expedia® for TD or directly with any vendor.

These two options are the most valuable ways to redeem your TD Rewards points, allowing you to enjoy a value of 0.5 cents per point when redeeming through Expedia® for TD and 0.4 cents per point when booking your own travel directly with vendors.

Thanks to their flexibility, TD Rewards Points can be very helpful to have around since they can help cover travel expenses that can’t be booked through other loyalty programs, like cruises, tours, and Disney tickets, saving you a fair amount of money on your next trip.

Additionally, with the Book Any Way feature, you can book an Airbnb or directly with a smaller boutique hotel and then apply your TD Rewards Points as a statement credit to offset the cost.

Also, if you redeem your TD Rewards Points against larger Book Any Way travel expenses, you’ll gain access to an improved redemption rate of 0.5 cents per point for any amount over $1,200.†

You can read more about these flexible points and how to maximize their value in our TD Rewards guide.

Additional Perks & Benefits

In terms of perks and benefits, the TD First Class Travel® Visa Infinite* Card offers a $100 travel credit on your first eligible hotel or vacation package bookings over $500 made through Expedia® for TD,† and the card also offers discounts on car rentals through Avis and Budget.†

The card also comes with four complimentary annual lounge passes through the Visa Airport Companion Program. With these passes, you can access participating lounges worldwide, which adds comfort and convenience to your travels.†

Additionally, you’ll receive a Birthday Bonus of points on your card’s yearly anniversary which is equal to 10% of the total number of points you earned throughout the past 12 months, up to 10,000 points.

What Else Does the Card Offer?

In addition to the strong earning rates, flexible points, and the perks listed above, the TD First Class Travel® Visa Infinite* Card also offers strong and varied travel insurance, including travel medical insurance, flight/trip delay insurance, trip cancellation/trip interruption insurance, car rental insurance, and more.

In fact, this card was voted as the winner of the 2023 Prince of Travel Awards for Best Credit Card for Travel Insurance!

The full breakdown of the insurance offered on this card is as follows:

- Common carrier travel accident insurance: Up to $500,000†

- Travel medical insurance: up to $2 million for 21 days (aged 64 and younger) or 4 days (aged 65 and older)†

- Flight/trip delay insurance: Up to $500 for delays of four hours or more†

- Trip cancellation insurance: up to $1,500 per person ($5,000 maximum)†

- Trip interruption insurance: up to $5,000 per person ($25,000 maximum)†

- Delayed and lost baggage insurance: Up to $1,000 for delays of six hours or more†

- Auto rental collision/loss damage insurance: Up to 48 consecutive days†

- Hotel/motel burglary insurance: Up to $2,500†

As a cardholder, you’ll also enjoy access to product protection and extended warranty coverage, plus mobile device insurance, all of which can save you a ton of money if your new mobile device or product gets accidentally damaged or stolen.

What We Wish It Offered

While the TD First Class Travel® Visa Infinite* Card is strong overall, there are a few areas that could be improved to make it a top-tier travel card.

First, the 2.5% foreign transaction fee makes it less appealing for purchases abroad. A great travel card should be the one you rely on both at home and while travelling.

Many hotels require payment upon check-in, which often means a foreign currency charge if you’re outside Canada. Add dining, transportation, and day-to-day expenses to the mix and suddenly you’re paying an extra 2.5% on almost everything. That’s far from ideal.

Another limitation is the lack of transfer partners. TD Rewards Points are flexible for fixed-value redemptions, but unlike programs such as American Express Membership Rewards, they can’t be converted into airline or hotel loyalty currencies. That limits your upside if you’re chasing premium flights or luxury hotel stays.

Lastly, redemptions outside of Expedia for TD only fetch 0.4 cents per point. It would be a major improvement if TD offered a flat 0.5 cents per point across all travel bookings, similar to how Scene+ points always redeem at 1 cent per point for any travel purchase.

This would be especially useful since platforms like Booking.com or Agoda sometimes price hotels more competitively in regions such as Asia.

Conclusion

The TD First Class Travel® Visa Infinite* Card is a great card for offsetting travel expenses thanks to its generous earning rates and consistently strong welcome bonus.

Earning TD Rewards Points, this card is particularly good at helping you cover travel expenses that are otherwise difficult to access with loyalty programs, such as Disney tickets, boutique hotels, and activities/tours.

Plus, with its solid travel insurance coverage, this card can support your adventures in more ways than one and is certainly worth considering if you’re able to take advantage of its many features and benefits.

† Terms and conditions apply. Please refer to the TD website for the most up-to-date product information.