Renting a car should be simple, but anyone who’s stood at the counter knows how fast the costs pile up. That “economy car for $39 a day” turns into $75+ once you add collision damage waivers, fees, and those sneaky “upgrade” suggestions.

The worst part? Many Canadians already have the coverage they’re being sold — they just don’t realize their credit card includes it.

With the right credit card, you can save on insurance, unlock car rental discounts, and even enjoy elite perks like upgrades or skipping the line.

It’s not just about saving money — it’s about making the rental process smoother with peace of mind.

Let’s explore what to look for, how to use these benefits properly, and which cards stand out from the rest.

What Makes a Great Credit Card for Car Rentals?

There’s more to renting a car than getting behind the wheel. A solid credit card should not only cover the basics but also step in when things go wrong — and ideally, make the process smoother.

At the core of rental benefits is coverage for damage or theft of the vehicle — commonly referred to as Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW).

Let’s be clear: CDW/LDW isn’t technically insurance. It’s a contractual waiver that protects you from paying for damage to the rental car — including theft, vandalism, and sometimes associated fees like loss-of-use or towing.

Most Canadian rental agencies charge $30–40/day for this waiver if you don’t already have it, but many premium credit cards provide this coverage at no extra cost — as long as you pay in full with the card and decline the rental company’s own CDW.

However, this doesn’t mean you’re fully protected. Credit card CDW/LDW coverage does not include third-party liability (damage to other vehicles, property, or people), nor does it cover medical bills or personal injuries.

Some premium cards offer travel emergency medical or accident insurance, which might provide some protection for you — but not for your passengers or anyone else involved.

And even then, coverage depends on your age, province, and eligibility. I sincerely hope you never have to find out where that boundary lies.

Coverage alone isn’t enough to be considered a great credit card. Some cards also grant elite status with Hertz, Avis, or National.

With National Car Rental’s Emerald Club Executive Elite® status, you can choose any car parked in the Executive Elite area.

With National Car Rental’s Emerald Club Executive Elite® status, you can choose any car parked in the Executive Elite area.

This lets you skip the counter and sometimes gets you upgraded to something better than the base model you booked. Others offer exclusive discount codes or corporate rates that reduce daily rental costs and waive some extra fees.

And while rare, there’s even a card that offers roadside assistance, which can be a lifesaver if your car won’t start or you get locked out.

Top Credit Cards for Car Rentals in Canada

Before we get into specific recommendations, here’s a quick overview of how several Canadian cards stack up for car rentals. Most include CDW/LDW with similar limits, but coverage duration and vehicle value limits can vary.

The Platinum Card® from American Express

This is one of the few cards that covers vehicles with an MSRP up to $85,000 CAD. If you’re booking a luxury SUV or something fancier than usual, that extra coverage headroom really matters.

The card also grants you elite status with Hertz and Avis, which can mean free upgrades, an additional driver at no extra cost, priority service, and skipping the counter altogether.

You’ll also benefit from Amex Platinum exclusive rates, which happen to be around 20% cheaper than retail based on my experience.

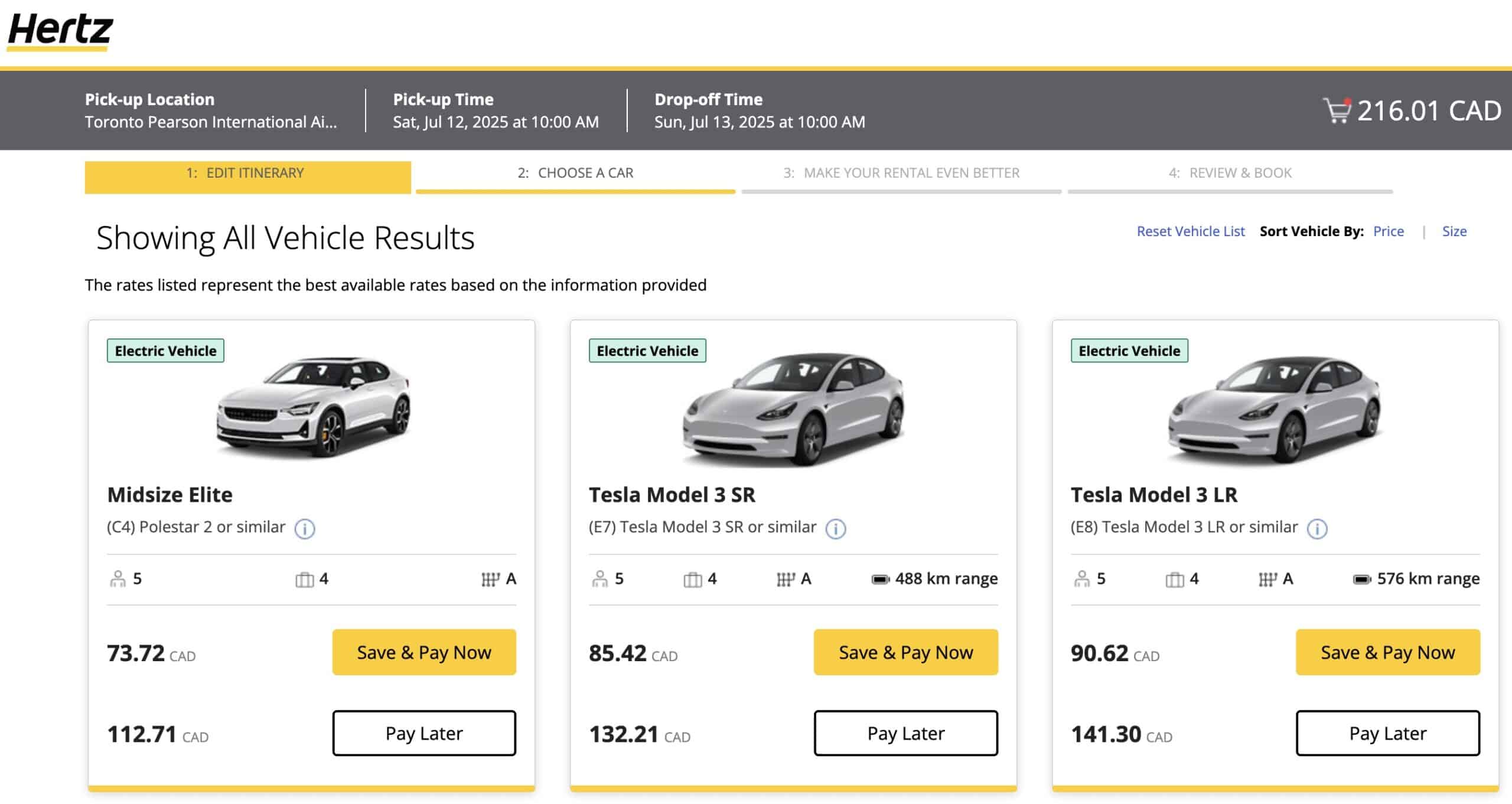

Hertz Amex Platinum Rate

1 of 2

But that’s not all.

Amex Platinum bookings include a complimentary 4-hour grace period, letting you return your rental later than the official time without getting hit with an extra day’s charge.

Hertz Amex Platinum rate complimentary 4-hour extension

Hertz Amex Platinum rate complimentary 4-hour extension

Say you’re going on a one-night trip and start your rental at 9 a.m. for a camping getaway three hours away. To avoid another day charge, you’d have to wake up at 6 a.m. and return it by 9 a.m. Not ideal if you’re not a morning person.

With the extended return window, you can bring it back by 1 p.m. stress-free.

However with the additional 4 hour window you can return your vehical by 1pm without getting hit with any fees.

The only downside is that this card comes with a high annual fee of $799, so it’s only worthwhile if you travel frequently — or if you want the full suite of Platinum perks to go along with your rental car benefits.

American Express Platinum Card

- Earn 100,000 MR points upon spending $10,000 in the first three months

- Plus, earn 50,000 MR points upon spending $50,000 in the first year

- Plus, earn 30,000 MR points upon making a purchase in months 15–17 as a cardholder

- Earn 2x MR points on all dining and travel purchases

- Receive an annual $200 travel credit

- Receive an annual $200 dining credit

- Transfer MR points to Aeroplan and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for daily expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Annual fee: $799

Scotiabank Gold American Express® Card

While it doesn’t come with rental car elite status or rate codes, this card still packs a punch.

It covers rentals up to $65,000 CAD for up to 48 days, and includes coverage for loss-of-use, admin, and towing fees — which many cards overlook.

One of the biggest perks is that it’s one of the few Canadian cards that charges no foreign transaction fees. If you’re renting a car abroad, this can save you a surprising amount.

It also earns 6x Scene+ points on Empire groceries, and 5x on other groceries and dining — making it an excellent all-around spending card.

It’s been my go-to card for booking car rentals over the past few years, and it still holds a top spot in my wallet.

While it doesn’t offer preferred rates or loyalty perks, car rental discounts do pop up from time to time via Amex Offers — giving it a slight edge over most Canadian Visas and Mastercards.

Scotiabank Gold American Express® Card

- Earn 20,000 Scene+ points upon spending $2,000 in the first three months

- Plus, earn an additional 20,000 Scene+ points upon spending $7,500 in the first year

- Earn 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, earn 5x Scene+ points on groceries, dining, and entertainment

- Also, earn 3x Scene+ points on gas, transit, and select streaming services

- Redeem points for a statement credit for any travel expense

- No foreign transaction fees

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $120

RBC® Avion Visa Infinite†

This well-known travel card includes CDW/LDW coverage for rentals up to $65,000 CAD and 48 days.

What makes it extra valuable is access to Hertz discount codes, usually offering around 20% off. That discount alone can quickly add up over a few rentals.

While it lacks loyalty status perks with car rental companies, its strong redemption flexibility and airline transfer partners make it an attractive travel companion, whether you’re driving or flying.

RBC® Avion Visa Infinite†

- Earn 35,000 RBC Avion points† upon approval†

- Earn 1.25x RBC Avion points† on qualifying travel purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120†

- Supplementary card fee: $50

Triangle™ World Elite Mastercard®

This card shines domestically. While the rental coverage maxes out at 31 days and doesn’t offer any elite status or rate codes, it includes one of the strongest roadside assistance packages of any Canadian credit card.

That includes five service calls per year, 250 km towing, and help with lockouts or dead batteries — a rare perk for a no-fee card.

If you’ve selected the Member Plan, the coverage applies regardless of which vehicle you’re driving or a passenger of — or how you’ve paid for the rental car.

This makes it the perfect companion card to use alongside one of the others. Use your main card for LDW/CDW coverage, and the Triangle™ World Elite Mastercard® for peace of mind on the road — all at no extra cost.

Canadian Tire Triangle World Elite Mastercard

- Earn 4% cash back at Canadian Tire, Sport Chek, Marks, and more

- Plus, earn 3% cash back at grocery stores

- And, earn up to 7 cents per litre in Canadian Tire money on eligible fuel purchases

- Free Canadian Tire Roadside Assistance Gold Plan

- No fee, no interest purchase financing at participating retailers

- Annual fee: $0

Using Credit Card Insurance Properly

Having insurance on your credit card is great — but it only works if you use it properly.

To be eligible, you must decline the rental agency’s CDW or LDW, and charge the full cost of the rental to your eligible credit card.

Most credit card policies cover you for up to 48 consecutive days, though some, like the Triangle™ World Elite Mastercard®, limit it to 31 days. Coverage usually excludes certain vehicle types — like cargo vans, exotic sports cars, or anything with more than eight seats.

Another common mistake? Not keeping documentation. If there’s an incident, your credit card issuer will expect you to submit proof of payment, damage reports, rental agreements, and possibly a police report — especially for theft or significant damage.

And remember, credit card CDW/LDW only protects the rental vehicle. It doesn’t cover damage you cause to others or their property, and it doesn’t cover medical bills or stolen personal items.

Some cards offer separate travel accident insurance, but this usually applies only to you, the cardholder, and varies based on age and province.

If you’re unsure or driving in unfamiliar conditions, it may be worth considering additional coverage from the rental company — particularly Personal Accident Insurance (PAI) or liability protection.

Is It Easy to File a Credit Card Insurance Claim?

Yes, but only if you’ve done everything right from the start.

Most credit cards require you to pay the rental company first, then submit a reimbursement claim. That said, in some cases — like a small windshield crack — the rental company may handle the paperwork directly with the insurer. (Been there in Edmonton!)

To stay on the safe side, make sure you keep all the paperwork: your rental agreement, proof of payment with the card, damage reports, repair invoices, and sometimes a police report.

The key is acting fast and following the steps. Many insurers require you to notify them within 48 hours, and you’ll usually have 30–60 days to file your claim with all supporting documents.

Each card has its own rules, timelines, and fine print, and missing just one requirement can lead to a denied claim.

I’ll cover the full claim process in a future post, but for now, read your card’s insurance booklet before your trip, and keep every receipt and report handy in case something goes wrong.

Conclusion

The best credit cards for car rentals in Canada do more than just cover you for scratches and dents. They help you avoid overpriced upsells, unlock loyalty perks, and even provide peace of mind with perks like roadside assistance — all while saving you real money.

Whether you’re heading out for a quick weekend escape or a longer road trip, choosing the right credit card can make the entire experience smoother, cheaper, and a lot less stressful.

And the next time the rental agent asks, “Would you like to add our damage waiver for peace of mind?”

you can smile and say, “No thanks. I’ve already got it.”