RBC® has just launched new welcome offers available on the RBC® ION Visa and the RBC® ION+ Visa cards.

Both cards offer elevated earning rates on many common daily expenses, which can be very useful as part of your overall RBC Avion Rewards strategy, as we’ll explore in detail below.

Let’s take a look at the offers and examine the many reasons why these cards should make their way into your wallet to optimize your RBC credit card strategy.

RBC® ION+ Visa: Get Up to $125 in Groceries†

The current welcome bonus on the RBC® ION+ Visa is 14,000 Avion points† upon approval, which is valued at up to $100 in gift cards†.

You’ll also receive 3,125 Moi Rewards points, which is worth up to $25 in groceries†, when you link your card to Moi Rewards, a loyalty program from Metro that allows you to earn and redeem points at stores like Metro, Food Basics, Super C, and Jean Coutu.

Moi points can be redeemed in $1 increments, starting at just 500 points for $4 off your grocery bill

The earning rates on the RBC® ION+ Visa are as follows:

-

Earn 3 Avion points per dollar spent on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions†

-

Earn 1 Avion point per dollar spent on all other eligible purchases†

For a small $4 monthly fee,† which adds up to $48 per year,† there’s also a basic set of insurance coverage, including mobile device insurance, purchase security, and extended warranty.†

The earning categories are nearly identical to the lower-tier RBC® ION Visa; however, the ION+ offers up to 3 Avion points per dollar spent† on many daily essentials, which is double the rate of the ION card.

Moreover, the additional elevated earnings categories on the ION+ also encompass dining and food delivery.†

Between the RBC® ION Visa and the RBC® ION+ Visa, you’ll want to pick the ION+ if you spend a lot on groceries, dining, food delivery, gas, transportation, streaming, digital gaming, and digital subscriptions, since you’ll earn 3 Avion points per dollar spent instead of 1.5x on the RBC® ION Visa.

There is no minimum income requirement to apply for the RBC® ION+ Visa,† and this offer is valid until June 11, 2025.

- Earn 14,000 Avion points upon approval†(worth up to $100 in gift cards†)

- Earn 3,125 Moi Rewards points upon linking to your Moi card†(worth up to $25 in groceries†)

- Earn 3x points† on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions†

- Earn 1 extra Moi Rewards point for every two dollars spent at Metro, Food Basics, Super C, Jean Coutu, Brunet and Première Moisson when you scan your Moi card and pay with your linked RBC Card (minimum purchase required).¹¹

- Mobile device insurance†

- Annual fee: $48 ($4 charged monthly)†

RBC® ION Visa: Get Up to $75 in Groceries†

The RBC® ION Visa is a no annual fee alternative offering 7,000 Avion points† as a welcome bonus upon approval, which is valued at up to $50 in gift cards†.

You’ll also earn 3,125 Moi Rewards points† when linked to your Moi account, which can be redeemed for up to $25 in groceries† at participating retailers like Metro, Food Basics, and more.

The card’s earning rates are as follows:

-

Earn 1.5 Avion points per dollar spent on qualifying grocery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions†

-

Earn 1 Avion point per dollar spent on all other eligible purchases†

This no-fee credit card is targeted towards casual travellers who spend a fair amount on rideshares, transit, streaming, and video games. In fact, it’s the only card to target spending in some of these categories, and will likely appeal to younger individuals who wish to earn flexible travel rewards.

The insurance coverage on the RBC® ION Visa is basic, which is fully expected on entry-level cards such as this one.

There is no minimum income requirement to apply for the RBC® ION Visa,† and this offer is valid until June 11, 2025.

- Earn 7,000 Avion points upon approval†(worth up to $50 in gift cards†)

- Earn 3,125 Moi Rewards points upon linking to your Moi card†(worth up to $25 in groceries†)

- Earn 1.5x Avion points† on qualifying grocery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions†

- Annual fee: $0

How to Use Avion Points from RBC® ION Cards

As a cardholder of the RBC® ION Visa or the RBC® ION+ Visa, you’ll enjoy membership in the Avion Rewards program at the Premium tier. Meanwhile, if you’re a cardholder of the RBC® Avion Visa Infinite†, the RBC® Avion Visa Platinum†, or RBC Avion® Visa Infinite Privilege†, you’ll enjoy membership in the Avion Rewards program at the Elite tier.

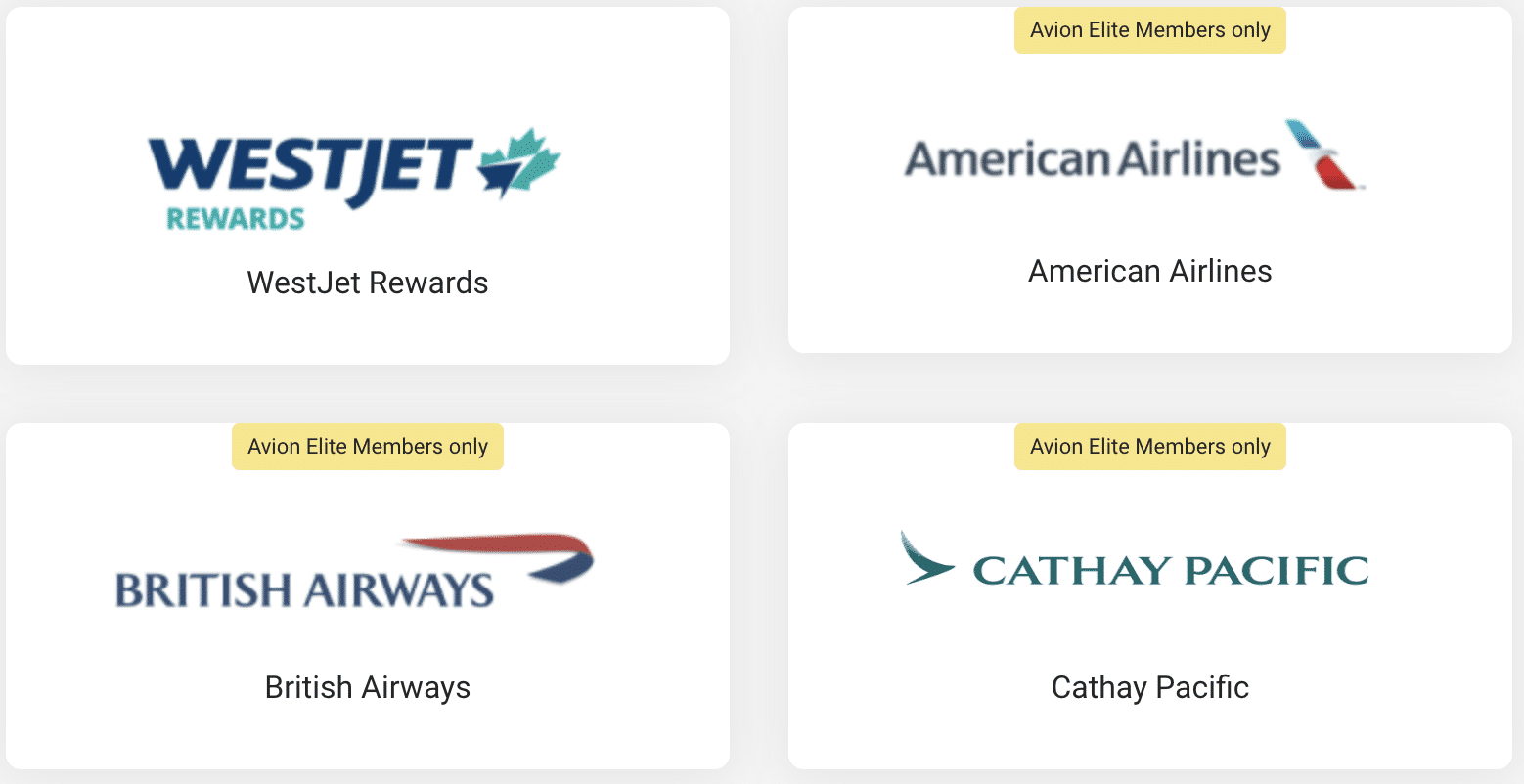

Premium members can’t transfer Avion points to three of the four airline partners available through the Avion Rewards program. The exception is WestJet Rewards, to which Avion points can be transferred at a rate of 1:1 (100 Avion points = 100 WestJet points).

Furthermore, ION and ION+ cardholders can’t redeem points via the Air Travel Redemption Schedule, which lets you use Avion points to book round-trip economy class tickets departing Canada, up to a certain maximum ticket price.

Instead, Premium members are limited to using Avion points at a flat rate of 0.58 cents per point (cpp) for travel booked via Avion Rewards, which is less valuable than the 1cpp redemption rate that you get from holding a higher-tier Avion card.

Luckily, if you also hold an Avion credit card, such as the RBC® Avion Visa Infinite† or the RBC® Avion Visa Platinum†, you can transfer Avion points earned from your ION product into Avion points at the Elite tier at a 1:1 ratio between your different cards.

Therefore, the Avion points you earn from either of the ION cards can still be converted into more powerful Avion points, as long as you also have an eligible Avion credit card (and therefore enjoy Elite membership in the Avion Rewards program).

| Credit Card | Best Offer | Value | |

|---|---|---|---|

55,000 RBC Avion points† $120 annual fee |

55,000 RBC Avion points† | $1,080 | Apply Now |

55,000 RBC Avion points† $120 annual fee |

55,000 RBC Avion points† | $1,080 | Apply Now |

Up to 70,000 RBC Avion points† $399 annual fee |

Up to 70,000 RBC Avion points† | $801 | Apply Now |

35,000 RBC Avion points $175 annual fee |

35,000 RBC Avion points | $700 | Apply Now |

35,000 RBC Avion points $120 annual fee |

35,000 RBC Avion points | $580 | Apply Now |

What’s more, if you ever decide to upgrade your ION or ION+ card to one of the RBC Avion cards, any points you’ve collected will be upgraded as well.

Then, you’ll be able to access higher-value travel redemptions that are exclusive to Avion cardholders: all four frequent flyer partner programs, the Air Travel Redemption Schedule, and the ability to redeem points directly against travel at 1cpp.

Indeed, this is what we like to call “The Optimized RBC Credit Card Portfolio,” since you can leverage the elevated earning rates on the ION family of cards with the more powerful redemption opportunities with the Avion family of cards.

Your points never expire for as long as you’re a cardholder. If you cancel or switch to a different RBC product, you have 90 days to redeem your points before they go away.

Conclusion

The RBC® ION Visa and RBC® ION+ Visa cards have elevated welcome offers for 7,000 and 14,000 RBC Avion points†, respectively, worth up to $50 and $100 in gift cards†.

In addition, both cards come with a bonus of 3,125 Moi Rewards points†, worth up to $25 in groceries† when you link your card to your Moi Rewards account.

The RBC® ION Visa and RBC® ION+ Visa not only fill a useful supporting role to the greater RBC® Avion portfolio, but also stand out on their own as unique product offerings to hold long-term.

The current welcome bonuses are great across the board, and you can upgrade both the new cards to a more premium Avion card anytime you wish to take advantage of RBC Avion’s excellent transfer partners.

These offers are valid until June 11, 2025, so be sure to apply before then and give your Avion Rewards balance a meaningful boost.