TD has introduced additional flexibility to its TD Rewards program, adding one brand-new redemption path and improving another.

While the Expedia for TD portal remains the best way to maximize value, these changes provide cardholders with more choice in how to use their points.

The New Redemption Options – What’s Changed?

Previously, “Book Any Way” redemptions were possible, but clunky. You had to submit an online form for each travel transaction (after it posted), and approvals often took about a week. Statement credit redemption existed too, but it was also not user friendly.

Now, TD has made both options more user-friendly:

- You can redeem points directly in the app (currently not yet visible on the web) for travel purchases made outside of Expedia for TD. Even better, TD has elevated the redemption rate on these direct travel purchases to $1 = 225 TD Rewards, up from the previous $1 = 250 TD Rewards.

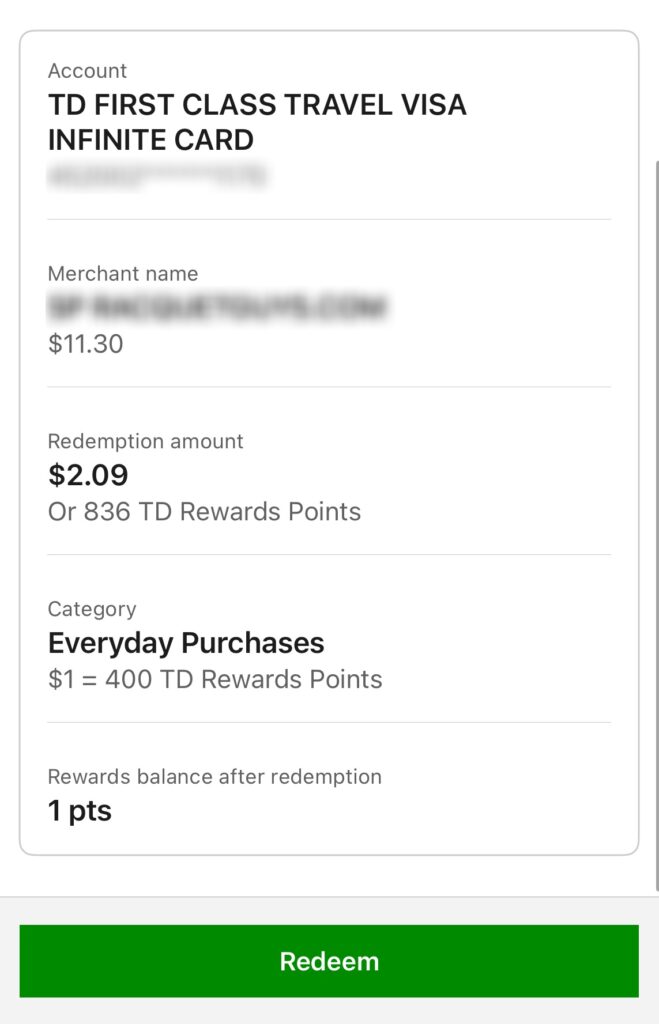

- The statement credit / past-purchases method is now simplified: you can redeem against any purchase from the past three statements via app for $1 = 400 TD Rewards.

These tweaks lower the barrier for using your points. Convenience, after all, is one half of the equation when deciding whether to redeem or hoard.

How the Numbers Compare

Here’s a quick overview of how the three main redemption paths now look like:

That shift from 0.4 to 0.44 cpp for direct travel is small in absolute terms, but meaningful for frequent travellers who want flexibility.

For example, the TD First Class Travel® Visa Infinite Card* is currently offering a welcome bonus of 165,000 TD Rewards points† plus at least 15,000 points from meeting the spend requirement (assuming base earning rate), for a total of 180,000 TD Rewards points†.

- Via Expedia for TD: at 0.5 cents per point = $900

- With the new direct travel rate: at 0.44 cents per point = $792

- Under the old Book Any Way: 0.4 cpp it’d be 180,000 × 0.004 = $720

So you’re giving up about $108 (12%) compared to Expedia for TD to access greater choice, but you’re gaining $72 (10%) relative to the old model.

These redemption improvements apply to all TD Rewards credit cards, including the TD First Class Travel® Visa Infinite* Card, the TD Platinum Travel Visa* Card, and the TD Rewards Visa* Card.

When Does It Make Sense to Use the New Options?

These changes are particularly useful in situations where Expedia for TD falls short.

For example, many everyday travel expenses such as rideshares, arranged transfers, hotel incidentals, ground transport, and local tours may not appear in Expedia’s ecosystem.

Being able to apply your points at 0.44 cpp against these charges adds a layer of flexibility that wasn’t as practical before.

You can now redeem TD Rewards at 0.44 cpp for direct travel expenses like high speed trains

You can now redeem TD Rewards at 0.44 cpp for direct travel expenses like high speed trains

It also matters in markets where other online travel agencies have stronger coverage. In much of Europe and Asia, platforms like Booking.com and Agoda often dominate hotel inventory, offering broader choices and more competitive pricing than Expedia.

In fact, Booking.com alone accounts for roughly 69% of Europe’s OTA hotel share. Having the ability to book where the footprint is stronger, and still redeem TD Rewards at the improved rate gives you more options to find the right property at the right price.

Another key advantage is when you want to keep your hotel loyalty benefits intact. Direct bookings are often the only way to earn points, elite qualifying nights or promotions, and to unlock perks such as complimentary breakfast, room upgrade, or late check-out.

Complimentary breakfast is one of the best perks of booking direct and holding hotel elite status

Complimentary breakfast is one of the best perks of booking direct and holding hotel elite status

With the higher redemption rate, the trade-off between maximizing your TD Rewards value and preserving your elite status is less of a deal than before, especially when you travel to destinations where the average hospitality is already beyond expectations, like Bangkok

Of course, a few cautions remain. Expedia for TD still provides the highest value at 0.5 cents per point, so it should remain the default when it works for your booking.

The 0.44 cpp direct travel option is best used when flexibility or loyalty recognition matters more than squeezing out that extra 0.056 cpp.

As for the 0.25 cpp statement credit feature, it’s far easier to use now but should still be treated as a backup, not a primary redemption strategy.

Overall, this is a welcome update that brings TD Rewards closer in line with other flexible programs. That said, it still lags behind Scene+ program, where you don’t lose any value when booking direct travel, and where redemptions can be applied to purchases up to 12 months old. By comparison, TD only allows redemptions on the past three statements.

Ultimately, it’s worth weighing whether the “book direct + redeem at 0.44 cpp” route gives you better benefits or pricing compared to Expedia for TD. In many cases it will, and that flexibility makes this update a welcome addition for TD Rewards cardholders.

Conclusion

The latest changes to TD Rewards won’t unseat Expedia for TD as the best way to redeem points, but they make the program far more flexible.

The improved 0.44 cpp rate for direct travel bookings is a welcome middle ground for those who value elite benefits, broader OTA coverage, or bookings that Expedia simply doesn’t cover. Meanwhile, the easier statement credit option provides a convenient fallback, albeit at lower value.

For TD Rewards cardholders, the takeaway is clear: keep Expedia for TD as your first choice, but don’t hesitate to take advantage of the new flexibility when the situation calls for it.

Frequently Asked Questions

Which TD cards can I use to redeem for Pay Off Purchases?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”TD First Class Travel® Visa Infinite*

TD Platinum Travel Visa*

TD Rewards Visa*

TD Business Travel Visa*”}},{“@type”:”Question”,”name”:”How far back can I redeem to pay off a Purchase Transaction?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”You can redeem against any eligible purchase within your past 3 monthly statement periods, including your current statement.”}},{“@type”:”Question”,”name”:”What is an “Eligible Purchase” for “Pay Off Purchases”?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Travel Purchases

Airline tickets

Hotels

Car rentals

Cruises

Travel Agencies and Tour Operators

Travel Purchases are determined by Merchant Category Codes (MCC) used by Visa to classify goods and services.

Everyday Purchases

All other purchases that are not defined above will be considered Everyday Purchases.”}},{“@type”:”Question”,”name”:”What are non-eligible purchases for Pay Off Purchases?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Cash Advances (including Balance Transfers, Cash-like Transactions, and TD Visa Cheques)

Interest charges

Fees

Adjustments

Refunds

Rebates or other similar Account credits.”}},{“@type”:”Question”,”name”:”How long will it take to see the Pay Off Purchases redemption credit on my Account?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”The credit will be applied to your Account within 2 business days. Your rewards balance will be updated immediately.”}},{“@type”:”Question”,”name”:”Can an Additional Cardholder make a redemption?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Yes, the Primary Cardholder and any Additional Cardholder can redeem TD Rewards Points.”}},{“@type”:”Question”,”name”:”What if I don’t have enough points or don’t want to pay in full?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”You can make partial redemptions on eligible purchases.

Please note the minimum redemption of $1 still applies to both full and partial redemptions.

Once a partial redemption has been made, you cannot make an additional redemption on that purchase.“}},{“@type”:”Question”,”name”:”What if I made my purchase in a different currency?“,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Your redemption will be based on the posted Canadian dollar value and your credit will also be in Canadian Dollars.”}}]}]]> Which TD cards can I use to redeem for Pay Off Purchases?

TD First Class Travel® Visa Infinite*

TD Platinum Travel Visa*

TD Rewards Visa*

TD Business Travel Visa*

How far back can I redeem to pay off a Purchase Transaction?

You can redeem against any eligible purchase within your past 3 monthly statement periods, including your current statement.

What is an “Eligible Purchase” for “Pay Off Purchases”?

Travel Purchases

Airline tickets

Hotels

Car rentals

Cruises

Travel Agencies and Tour Operators

Travel Purchases are determined by Merchant Category Codes (MCC) used by Visa to classify goods and services.

Everyday Purchases

All other purchases that are not defined above will be considered Everyday Purchases.

What are non-eligible purchases for Pay Off Purchases?

Cash Advances (including Balance Transfers, Cash-like Transactions, and TD Visa Cheques)

Interest charges

Fees

Adjustments

Refunds

Rebates or other similar Account credits.

How long will it take to see the Pay Off Purchases redemption credit on my Account?

The credit will be applied to your Account within 2 business days. Your rewards balance will be updated immediately.

Can an Additional Cardholder make a redemption?

Yes, the Primary Cardholder and any Additional Cardholder can redeem TD Rewards Points.

What if I don’t have enough points or don’t want to pay in full?

You can make partial redemptions on eligible purchases.

Please note the minimum redemption of $1 still applies to both full and partial redemptions.

Once a partial redemption has been made, you cannot make an additional redemption on that purchase.

What if I made my purchase in a different currency?

Your redemption will be based on the posted Canadian dollar value and your credit will also be in Canadian Dollars.